Latest Posts

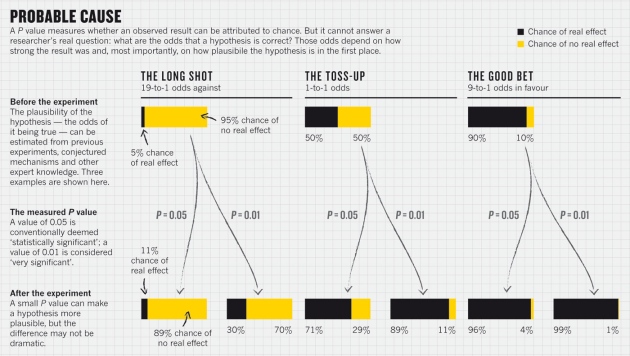

Quick hit: Bayesian Statistics

Bayseian probability seems quite obvious once it is explained, but it is incredibly counterintuitive. Using Bayesian methods is one of the “thinking slow” methods that Daniel Kahneman in Thinking Fast and Slow identifies – very few people can do it intuitively. So via Barry Ritholtz, here is a great example ofContinue Reading

Management ideas come from surprising places

This week at work we had an hour long session with Tim Sharp from the Happiness Institute. He was talking about the power of optimism, and why optimism is not just positive thinking, but is about focusing on the positives, on those things you have control over, and just getting onContinue Reading

Book Review: The Why Axis: Hidden Motives and the Undiscovered Economics of Everyday Life

The Why Axis: Hidden Motives and the Undiscovered Economics of Everyday Life, by Uri Gneezy and John List When I discovered this book, I realised it was the perfect book for this blog. A book about behavioural economics, which also examines gender and other discrimination through an economic lens. WhatContinue Reading

Blogging for actuaries

There are as many schools of thought about blogging as there are blogs. Everyone has their own reason, but here are a few of my favourites: It gives you a creative outlet Blogging is a creative activity. The act of crafting a post, working out what your message isContinue Reading

The gender gap in longevity

People continue to live longer and longer around the world (for an interesting discussion of how superannuation should respond, see Paul Keating on Cuffelinks), which is mostly good. But different parts of populations have quite different experiences of mortality improvement. The (UK) Institute of Actuaries publishes a regular longevity bulletin. TheContinue Reading

Book roundup for 2013

As an annual exercise, I’ve done a quick review of all the non fiction books I read in 2013. You can find it here. Enjoy! The 2012 one was here.Continue Reading

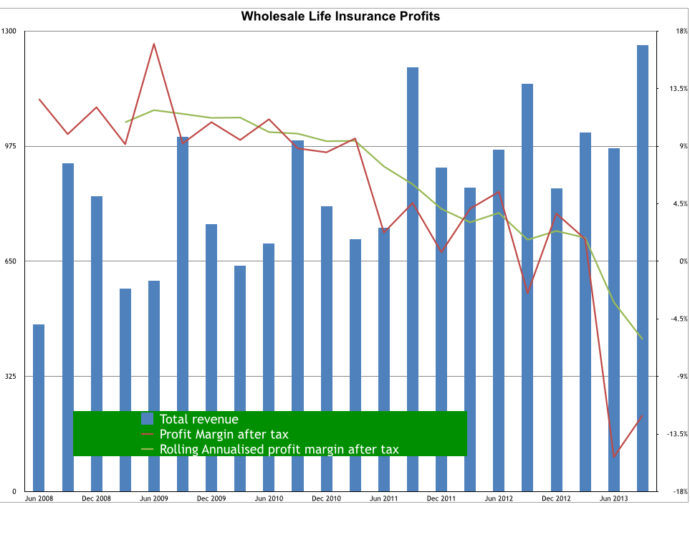

Life insurance in Australia – profits falling

A few months ago, I posted about some press actuaries had received about their crystal balls proving inadequate in the life insurance industry. Well the news hasn’t been getting any better. Recent reports from two of Australia’s major life reinsurers have continued the bad news. Most recently, APRA released theirContinue Reading

The business kiss

One of my earliest posts on this blog was about the business kiss. When is the right time to kiss in business? We had a long discussion about this at work the other day; probably because we were at a combination farewell and Christmas dinner – both events guaranteed toContinue Reading

Extreme weather events – they’re not as extreme any more

As Sydney continues to be ringed by fire, it seems a good time to repost something I wrote about extreme weather events after the Black Saturday bushfires. I’m with Adam Bandt, now is the time to be talking about climate change, and its impact on the extremes of weather.Continue Reading

Actuaries’ crystal ball found wanting

Today there was a comment about actuaries in the Financial Review – in a much more prominent place than most actuaries achieve. The context was a downgrade to AMP profit expectations, but it has wider interest in that Chanticleer finds actuaries in the life insurance industry wanting: Actuaries have a wonderful reputationContinue Reading