Get a bunch of actuaries together (particularly life insurance actuaries) and sooner or later we will start talking about pandemics. Fortunately for us, our experiences are almost entirely theoretical. We’ve lived through AIDS (for the life insurance actuary, a very slow-moving pandemic, where the challenge was more about underwriting than claims and capital) and SARS (which, from Australia, was more economic than insurance related) and the 2009 Swine Flu, which was (from an insurance industry perspective) almost entirely about PR. The Ebola outbreak in 2014 was almost entirely confined to western Africa, despite creating a lot of fear mongering press at the time.

But one day, our industry will be called upon to deal with a real pandemic, something like the “Spanish Flu” pandemic of 1918.

If you are unlucky enough to live in Wuhan, China, and have been in quarantine for weeks, the experience of the Novel Coronavirus is starting to resemble the experience of the Spanish flu in 1918.

It is too early to say how seriously the Novel Coronavirus will impact the globe, but with the news today that the number of deaths has exceeded the SARS deaths in 2003, it is clearly very serious for China.

Here is the WHO site which collects together all the official information from around the world.

I’ve written a bit about pandemics in the past on this blog, not so much on the technical medical details, but the societal implications and the implications (such as stress testing and underwriting) for insurers.

If you are interested in the parallels, a fascinating book is The Great Influenza, by John M Barry (which I reviewed here). The book is the story of the “Spanish Flu” – in 1918 and 1919 (depending on where you were in the world) a deadly influenza swept the world, killing between 50 million and 100 million people.

The book tackles this from a totally US angle, topping and tailing the main story with stories of how US medicine changed from being close to being based on folklore, to being a scientific enterprise understanding the immune system and the way in which bacteria and viruses work. The main focus is the way in which politics, both on a local, and a national scale, managed to make the government responses not just inadequate, but, in many cases, contributory to greater death rates.

Definitely worth reading if you are interested, particularly as the tips on what to do if the medical system is overwhelmed seem increasingly likely to be useful in China, hopefully not so much in other parts of the world.

As a more professional resource, Alex Stitt, an Australian actuary, wrote a paper in 2006 about pandemics for the life insurance actuary. It is here in pdf. It’s a great survey of all the things you should think about if you are involved in an insurance company, or a financial services company exposed to financial markets and operational risk.

From everything I’ve read, the most useful advice for people not in China is to get in the habit of basic hygiene, so that if the coronavirus makes it here, you are already ready. Get into the habit of washing your hands frequently, covering your mouth (not with your hand) when you cough and sneeze, and frequently washing surfaces that might be infected. Try and remember not to touch your mouth or nose with your hands.The daily WHO briefing document (9 February is the latest as I write this) ends with very this sensible advice for everyone:

• Avoiding close contact with people suffering from acute respiratory infections.

• Frequent hand-washing, especially after direct contact with ill people or their environment.

• Avoiding unprotected contact with farm or wild animals.

• People with symptoms of acute respiratory infection should practice cough etiquette (maintain distance, cover

coughs and sneezes with disposable tissues or clothing, and wash hands).

• Within health care facilities, enhance standard infection prevention and control practices in hospitals, especially

in emergency departments.

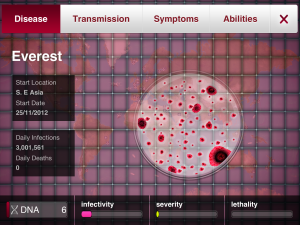

And for a bit of light relief, if you want to understand how pandemics work a bit better – the game Plague Inc is educational, scary, and fun at the same time.

Thanks for the good wrap on my 2006 paper, Jennifer. Hopefully early next week a whirlwind update dealing with the Coronavirus 2019-nCoV (our current black beast) will appear in Actuaries Digital. That article points back particularly to sections 12 and 14 of the 2006 paper as each seemed to me still very relevant in considering the risks a financial institution might be facing, and some of the steps they can take to help themselves and their members do the best to protect themselves. Cheers. Alex Stitt

The Actuaries Digital article is now live here https://www.actuaries.digital/2020/02/13/coronavirus-what-every-actuary-advising-an-australian-financial-services-organisation-should-know/

It embeds another link to a useful site for monitoring developments in addition the the WHO site you link to. Cheers, Lx